Published on July 25, 2022

The Town Council and School Board will be holding a joint workshop on Tuesday, July 26, 2022 at 7:00 p.m. at the Fire Station. The purpose of this workshop is to review the new schools building project and draft language for a bond referendum in November. The council will hold a public hearing on the proposed bond at the regular council meeting on August 8, with the expectation that the council will be prepared to vote on the bond language at a special meeting August 22.

In preparation of the joint workshop and in anticipation of potential borrowing, the council requested a fiscal review of the town’s finances. Joe Cuetara of Moors & Cabot Investments, the primary lead for the majority of the town’s bonding projects since 1989, provided a presentation to the council during the July 11 council meeting.

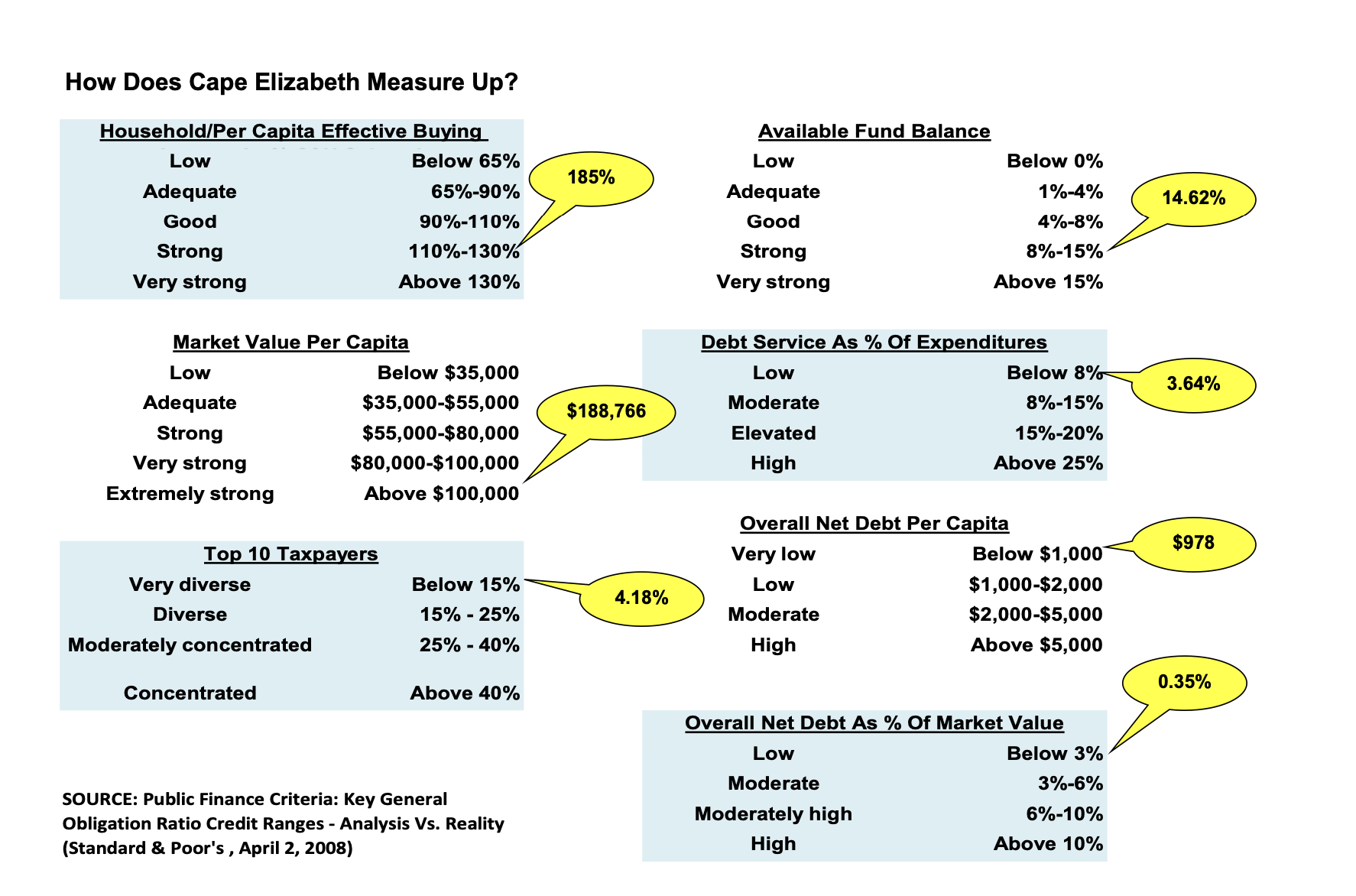

Referencing both rating agencies Moody’s and Standard & Poors, Cuetara said that he preferred S&P’s posture towards fund balances, “It’s not what your fund balance is, but how you use it. I am looking at two months or 16.6% of your expenditures to be held in a fund balance.” Currently, Cape Elizabeth is given S&P’s highest and best bond rating at AAA and Moody’s second best at Aa1.

Cape Elizabeth’s debt service as a percentage of expenditures at 3.64%, is considered very low. Moderate, according to the S&P is between 8%-15%. Having less than this range suggests that, “You are letting your infrastructure deteriorate, letting your assets fallow and creating greater problems and expenses in the future,” Cuetara said. Fund balances higher than 12% suggest over-leveraging. Cape Elizabeth’s overall net debt per capita at $978, “Is incredibly low in terms of your ability to borrow if you want to,” he added. The median in Maine, is approximately $3000. Borrowing, Cuetara explained, allows you to “borrow an asset for 20 years” and is “less of an evil in terms of spreading the useful life of the asset and benefits are received by the users of the asset.”

Overall net debt as a percentage of market value is considered moderate, between 3%-6%. Cuetara said, “Above 3% is a warning; below 3% makes you wonder if you are maintaining infrastructure?” Cape Elizabeth’s overall net debt as a percentage of market value is 0.35%.

The presentation included, “The town can maintain better credit characteristics than the nation in a stress scenario based on its predominantly locally derived revenue base and our view that pledged revenue supporting bond debt service is a limited risk of negative sovereignty intervention.” In terms of debt management, Cuetara commended the town’s strong management and very strong liquidity, with total government available cash at 28.5% of total government fund expenditures (2020). Very strong debt and contingent liability profile, with debt services carrying charges at 4.0% of expenditures and net 95% of the town’s tax base.

Debt is falling off precipitously. In 2017 the town’s total debt was over $16 million; debt as a percentage of market value was 0.84%; and debt per capita was $1,776.93. As of 2021, the town’s total debt is $9.3 million; debt as a percentage of market value was 0.38%; and debt per capita is $977.87. Cuetara reiterated that, “3% is acceptable; 2% is perfect; ours, at 0.38% is impossible. This all shows that you have a certain amount of buying power.”

Cuetara did advise that the town consider revising its fund balance policy and aim to strike a greater balance between debt and reserve. “If everything is going to be reserved, it puts an unfair burden on taxpayers and provides an unfair advantage to future taxpayers who will enjoy the asset without paying for it. On the other hand, an excess of debt would put a burden on the taxpayers. You have to decide the balance,” he said.

Following Cuetara’s presentation, councilor Nicole Boucher asked whether or not the town’s bond rating would go down if they chose to bond for new schools, “What is the purpose of bond ratings? Is it bad for bond ratings to go down?” Cuetara answered that it wasn’t necessarily true, “If you don’t take care of your buildings, then bond ratings will go down. It’s how you take a proactive stance before you borrow and how you position yourself. If it’s structured correctly; if it’s presented correctly; there should be no change in your rating — especially with net debt per capita of $978 and debt service as a percentage of expenditures at 3.64%.”

To access the full presentation click here.

To view the video from July 11, 2022 Town Council meeting, click here.

Image courtesy of Joe Cuetara, Moors & Cabot Investments